In the realm of banking and financial management, the Risk-Adjusted Return On Capital (RAROC) stands as a vital metric, offering insight into the efficiency and profitability of financial assets while considering the associated risks. Under the International Financial Reporting Standard 9 (IFRS 9), understanding RAROC becomes even more crucial due to its emphasis on expected credit losses and their impact on financial reporting. This article explores RAROC under IFRS 9, focusing on its calculation and significance in financial analysis.

What is RAROC?

RAROC is a performance measure commonly used in banking practice to evaluate the returns generated by financial assets relative to the risks involved. It quantifies the return earned on capital employed, factoring in the level of risk inherent in the assets. In essence, RAROC helps financial institutions assess whether the returns from a particular investment justify the risks taken.

Calculating RAROC under IFRS 9

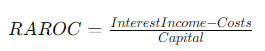

The calculation of RAROC under IFRS 9 involves several components, with a particular focus on expected credit losses (ECL). Engelmann & Pham (2020) proposed a formula that incorporates the Expected Loss Coverage (ELC) over the lifetime of a loan:

Where:

- Interest Income: This includes the income generated from the financial asset, typically in the form of interest payments or dividends.

- Costs: Costs encompass various expenses associated with the asset, such as funding costs, operational costs, and expected credit losses.

- Capital: This represents the amount of capital allocated to cover unexpected losses. It acts as a buffer against potential defaults or credit losses.

Engelmann & Pham’s formula emphasizes the importance of Expected Loss Coverage, which reflects the anticipated credit losses over the lifetime of the asset. By incorporating ELC, the formula provides a more comprehensive assessment of risk-adjusted returns.

Significance of RAROC under IFRS 9

Risk Management:

RAROC helps financial institutions in effectively managing risk by aligning returns with the level of risk exposure. It allows banks to allocate capital efficiently to mitigate potential losses.

Financial Reporting:

Under IFRS 9, the recognition of expected credit losses significantly influences financial reporting. RAROC provides insights into the impact of credit losses on the profitability of financial assets, aiding in transparent financial reporting.

Performance Evaluation:

RAROC serves as a key performance indicator (KPI) for assessing the performance of financial assets. It enables comparisons across different investments and helps in decision-making regarding resource allocation.

Capital Allocation:

By considering the risk-adjusted return, RAROC assists banks in optimizing capital allocation. It helps in determining the optimal mix of high-return, high-risk assets and low-risk, low-return assets.

Conclusion:

In conclusion, RAROC plays a crucial role in financial management under IFRS 9, offering a comprehensive perspective on the relationship between returns and risks. Understanding and calculating RAROC enables financial institutions to make informed decisions, manage risks effectively, and maintain transparency in financial reporting. As financial landscapes continue to evolve, RAROC remains a fundamental metric for evaluating performance and ensuring sustainable growth.

Muzammal Rahim Khan is the CEO and Co-Founder of FineIT, bringing over 15 years of expertise in software development, implementation, and technical consulting across global markets including the U.S., U.K., Europe, Africa, and Asia. He has led the design and delivery of enterprise-grade solutions that modernize compliance, risk management, and financial reporting for banks and financial institutions. Under his leadership, FineIT has built flagship platforms such as Estimator9 (IFRS 9) and ContractHive (IFRS 16), empowering clients with automation, accuracy, and audit-ready confidence. Muzammal combines deep technical knowledge with strategic vision, driving innovation that bridges regulatory requirements with practical, scalable technology. His focus remains on building resilient, future-ready solutions that strengthen trust and efficiency in financial services.